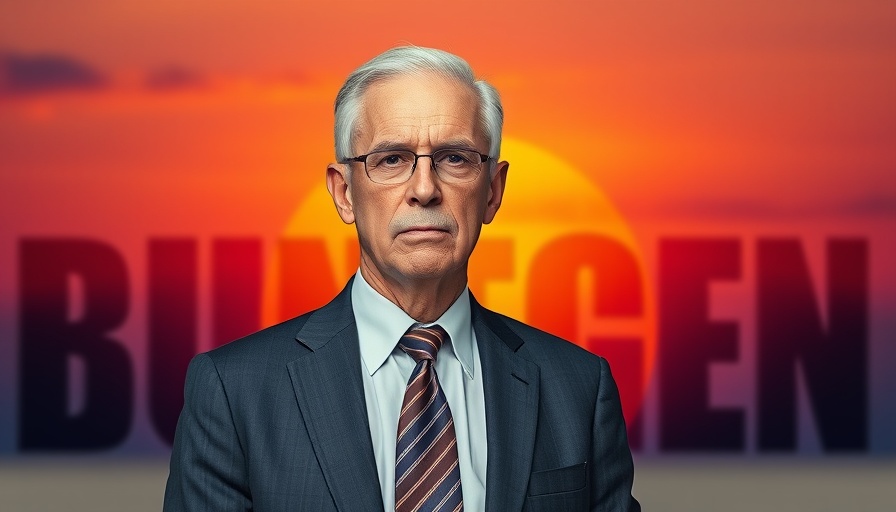

Greg Abel's Leadership Challenge at Berkshire Hathaway

As Warren Buffett prepares to step back from his role at Berkshire Hathaway, the spotlight now turns to his successor, Greg Abel. Leading one of the most revered investment conglomerates in history presents a unique set of challenges. But who is Greg Abel, and what strategies might he employ to uphold Buffett's legacy?

The Weight of Expectations

Warren Buffett is not merely the face of Berkshire Hathaway but a retail icon synonymous with wise investments and ethical business practices. With Abel now in the role of leading the company, he must navigate the expectations of investors who have long revered Buffett’s methods. This transition offers a pivotal moment for Abel to define his leadership style while preserving the core values that have guided Berkshire's substantial growth.

Corporate Culture and Leadership Style

Greg Abel has been involved in Berkshire’s operations for nearly 20 years. Known for his straightforward approach and ability to attract top talent, he embodies a corporate culture that values autonomy among its subsidiaries. This leadership style is essential, considering Berkshire’s decentralized nature allows individual businesses to thrive independently. As he steps into his new role, how Abel supports this culture will be crucial for future success.

The Importance of Long-Term Vision

One of the defining characteristics of Buffett's leadership is his investment in long-term games, favoring patience over short-term profits. As Abel steps up, he will likely carry this philosophy forward, reassuring investors who may question the direction of their investments during the transition. He must articulate a vision that not only honors Buffett’s legacy but also resonates with modern economic conditions.

Challenge of New Market Dynamics

The economic landscape continues to evolve, bringing with it fresh challenges. Trends in technology, shifting consumer behavior, and the rise of sustainability initiatives demand prompt and calculated responses from business leaders. Abel's ability to adapt to these trends and implement innovative strategies will be critical. He may also need to balance more aggressive management as competition intensifies in industries where Berkshire holds considerable interests.

Leveraging Innovation and Sustainability

In a world where business practices emphasize corporate social responsibility and sustainability, Abel's strategies may very well include investing in companies that prioritize environmental stewardship. This not only aligns with wider consumer sentiment but may also position Berkshire as a progressive leader among corporate giants. Considering the firm’s extensive portfolio, where can innovation play a role in its investments moving forward?

Future Predictions: The Path Ahead for Berkshire Hathaway

Investors will be keenly watching how Abel leads Berkshire Hathaway in an era of increased volatility from economic shifts. Would he pursue more acquisitions as seen in previous years? Perhaps he will reverse course, focusing on reinvestment in existing businesses. The success of this leadership transition may hinge on his agility in navigating an economy rife with uncertainty.

Conclusion: A Call to Pay Attention

As Greg Abel takes on the mantle of leadership at Berkshire Hathaway, both industry insiders and casual observers of the market should remain attentive to the changes and the strategies he employs. The road ahead may be daunting, but it is also an opportunity for transformation and growth. Following his journey could provide insights not only into the future of Berkshire but also into the evolving landscape of corporate leadership itself.

Add Row

Add Row  Add

Add

Write A Comment