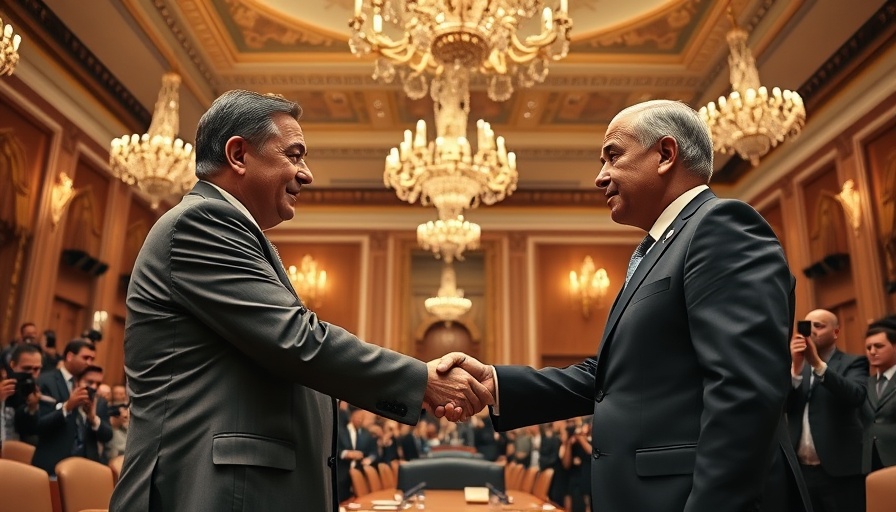

Tensions and Potential Alliances: What a Modi-Trump Meeting Could Mean

The political theater surrounding the potential meeting between Indian Prime Minister Narendra Modi and former President Donald Trump, set against the backdrop of the UN General Assembly next month, shines a spotlight on the evolving dynamics between the two nations. This meeting comes at a crucial time, especially amidst Trump's recent tariff announcements aimed at penalizing India. With Modi's likely presence in the U.S. on September 26, the agenda may not only revolve around diplomatic niceties but also address broader economic concerns that could affect investors on both sides.

Unpacking the Trade Tensions: A Necessary Discussion

As reported, one of the primary goals of Modi's visit will be to address trade and tariff issues that have been straining U.S.-India relations. With Trump’s announcement of a new 25% tariff on Indian goods, the stakes couldn’t be higher. These trade tensions pose a direct impact on various sectors, potentially affecting financial markets.

Investor confidence is sensitive to international relations, and significant tariffs can lead to fluctuations in stock market performance, particularly in industries reliant on trade with India. A productive dialogue between Trump and Modi could pave the way for improved trade relations, instilling hope among investors looking for stability in sectors such as technology and manufacturing.

The Bigger Picture: Geopolitical Context and Economic Influence

The meeting is not solely about tariffs; it represents broader geopolitical maneuvering. Both Modi and Trump are influential leaders navigating the tumultuous waters of international politics, and their collaboration could significantly shape the strategic landscape of the Indo-Pacific region. Improved ties could suggest mutual cooperation in defense and technology sectors, inviting substantial investments from startups to established firms.

For investors, this geopolitical context is crucial. Following Modi’s visit, sectors poised for growth may include technology stocks focused on international markets and startups leveraging new trade opportunities. Keeping a close eye on these developments is essential for investors seeking to capitalize on emerging market trends.

Understanding the Domestic Impact on Indian Markets

The prospect of Modi meeting Trump has a direct correlation with the Indian stock market as well. Uncertainty in trade policies often translates into volatility within the stock market, affecting investments from mutual funds to ETFs. Domestic investors should be prepared for possible fluctuations based on how negotiations unfold, especially in industries heavily reliant on exports.

Moreover, this meeting comes at a time when India is striving to enhance its global positioning, especially with emerging markets. Investors should consider adjusting their portfolios in response to potential shifts in economic policies stemming from the outcomes of this high-stakes engagement.

An Insight into Investment Strategies Amid Global Changes

As Modi gears up for this meeting, investment strategies must adapt to the evolving geopolitical climate. For those interested in portfolio diversification, this is a critical moment to assess exposure to international markets. Investors might want to explore sectors like sustainable investing, crypto assets, or any real estate investment trusts (REITs) affected by international relations.

Utilizing investment research tools and staying abreast of stock market trends can provide insights into sectors that may benefit from improved diplomatic relationships. Investors should also consider the implications of dollar-cost averaging strategies as global market conditions fluctuate, ensuring they maintain a balanced risk profile during unpredictable times.

Looking Ahead: Predictions and Opportunities

As the date of the meeting approaches, predictions abound. Analysts speculate that if Modi and Trump can come to reasonable agreements on tariffs, the positive outcomes could lead to improved economic robustness not just for the U.S. and India, but globally. Global investing opportunities may present themselves in the wake of these negotiations, particularly in technology and healthcare sectors.

Investors should prepare for various outcomes: from enhanced cooperation yielding significant dividends in stock performance to possible disagreements that may trigger volatility in volatile sectors. It’s essential to have strategies in place, whether focusing on high-yield bonds or diversified ETFs, to navigate the varying market conditions.

Your Next Steps: Stay Informed

As we eagerly anticipate what unfolds from Modi’s trip to the U.S., it’s crucial for investors to stay informed about developments in U.S.-India relations that affect financial markets. Enhance your investment strategies by integrating current events and geopolitical happenings into your decision-making process. By understanding the implications of high-profile meetings like this, investors can position themselves to seize opportunities as they arise.

Being aware of tariff implications, trade discussions, and potential policy shifts will enable informed investment decisions in uncertain times. Prepare to act on trends, reassess your precise asset allocations, and consider exploring new investment avenues in response to evolving global landscapes.

Add Row

Add Row  Add

Add

Write A Comment