Warren Buffett's Stark Warning Comes True: Prepare for Deep Cuts to Social Security

Warren Buffett's longstanding caution about the future of Social Security is now crystallizing into a grim reality. Recent analyses from the Committee for a Responsible Federal Budget (CRFB) indicate that unless Congress intervenes, Social Security's main trust fund could face insolvency by the end of 2032, which would lead to devastating reductions in benefits for retirees—potentially up to $18,000 less per year.

Understanding the Financial Cliff Ahead

The CRFB's findings outline a worrying forecast: by late 2032, payments from Social Security will be limited strictly to what is collected via payroll taxes. This drastically alters the landscape for millions of retirees who rely heavily on these benefits for their income. For instance, a typical dual-earning couple retiring in early 2033 could see their annual benefits slashed by around $18,100, translating to a staggering 24% reduction, directly impacting over 62 million Americans.

A Closer Look at the Cuts by Income Level

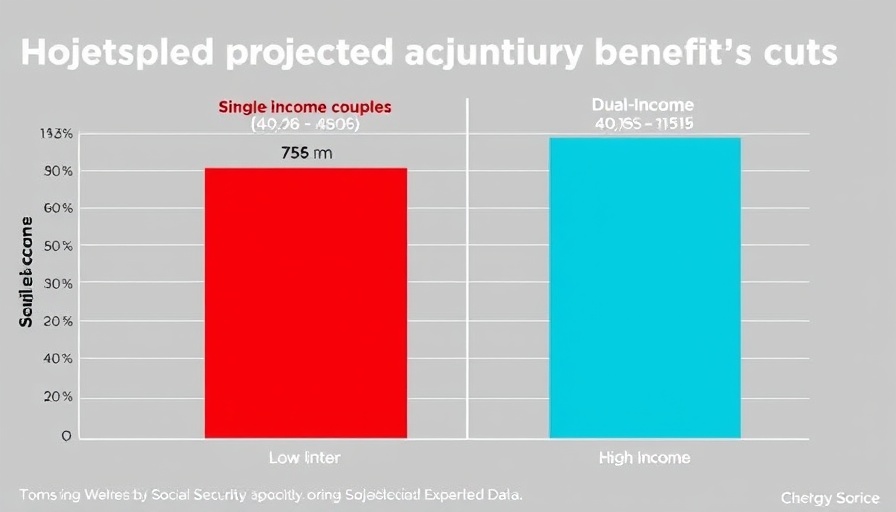

These impending cuts will not be evenly felt across all income brackets. Single-earner couples might face a $13,600 reduction, while higher-income couples could lose up to $24,000 a year. Notably, while lower-income households might see smaller actual dollar cuts, the relative impact on their already tight budgets will be disproportionately severe, consuming a much larger share of their total retirement income.

The Root Causes of Social Security's Financial Strain

The issue stems from a widening gap between Social Security's benefits and its income, fueled by increasing payments alongside decreasing revenue from payroll taxes. The recently proposed One Big Beautiful Bill Act (OBBBA) further complicates these dynamics, aiming for revenue reductions that could hasten this financial crisis by limiting Social Security funds more quickly. If these measures are made permanent, retirees may face even starker realities when it comes to their benefits.

What This Means for Business Professionals

As business professionals navigate their own financial futures, the pending cuts to Social Security should act as a robust signal to evaluate personal retirement strategies and consider diversifying income sources. With economic forecasts hinting at stark changes in Social Security, careful planning and investment could make all the difference for long-term financial health.

For business professionals, understanding the broader implications of Social Security's potential insolvency is crucial. It highlights the importance of sustainable investing practices and the need for personalized retirement planning that accounts for possible changes to government-supported programs.

Add Row

Add Row  Add

Add

Write A Comment