Uranium Production Surges: What It Means for Investors

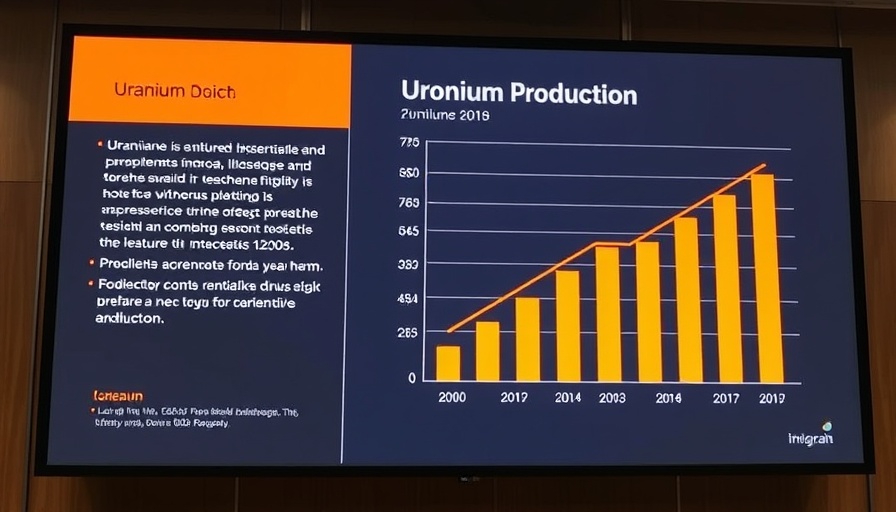

Boss Energy has recently reported a remarkable surge in uranium production of 116% for the third quarter of FY2025. This uptick not only marks a significant operational milestone for the company but also provides a potential insight for investors looking to optimize their portfolios amid changing market dynamics. For those involved in investment strategies revolving around commodities, this news highlights an area of growth that could yield substantial returns.

The Emergence of Free Cash Flow: A Positive Indicator

In conjunction with increased production, Boss Energy has also achieved its first free cash flow, a crucial step for any business. Free cash flow indicates the cash a company generates after accounting for capital expenditures, which can be used for various purposes including reinvestment in the business, paying dividends, or strategic acquisitions. This financial health may attract investors who prioritize dividend stocks or are interested in sustainable investing, showing resilience in a volatile market.

Context: The Global Demand for Uranium

The global push for sustainable energy sources has heightened the demand for uranium, as countries look to nuclear power to reduce carbon emissions. The trend towards cleaner energy is prompting new investments and interest in areas like uranium mining, making it a potentially lucrative sector for portfolio diversification. Investors need to pay attention to how market demand influences uranium prices as they consider commodities trading.

Future Predictions: Emerging Markets and Uranium

As the world shifts towards renewable energy, uranium might witness a continued upward trajectory. Analysts predict that the transition could open up new opportunities in emerging markets investments, where demand for energy sources is expected to rise significantly. Companies involved in uranium production, like Boss Energy, may be well-positioned to capitalize on this growing need, indicating a bright future for stock picking in this sector.

Investment Strategies in Uranium: What to Consider

For those considering investing in uranium, understanding the underlying factors that influence price trends and production levels is crucial. Strategies could include buy-and-hold investing for those looking at long-term growth, or more active approaches like trading strategies to take advantage of market volatility. Due diligence and thorough investment research tools should be employed to assess risk factors associated with this sector.

The Bigger Picture: Broader Implications for the Market

The success of companies like Boss Energy serves as a compelling case study in the broader context of stock market trends. Factors such as geopolitical stability, regulatory changes, and advancements in energy technology play significant roles in shaping investor sentiment. For investment apps and platforms, highlighting industries that align with global sustainability goals could attract a growing demographic of socially conscious investors.

Conclusion: Why Investing in Uranium Matters

The recent developments from Boss Energy present an exciting narrative for investors. Understanding the implications of increased uranium production and the significance of achieving free cash flow can provide valuable insights into potential investment strategies. As the market evolves, adapting to these changes could enhance financial independence investing and lead to successful outcomes for those willing to engage with the complexities of uranium investments.

Add Row

Add Row  Add

Add

Write A Comment