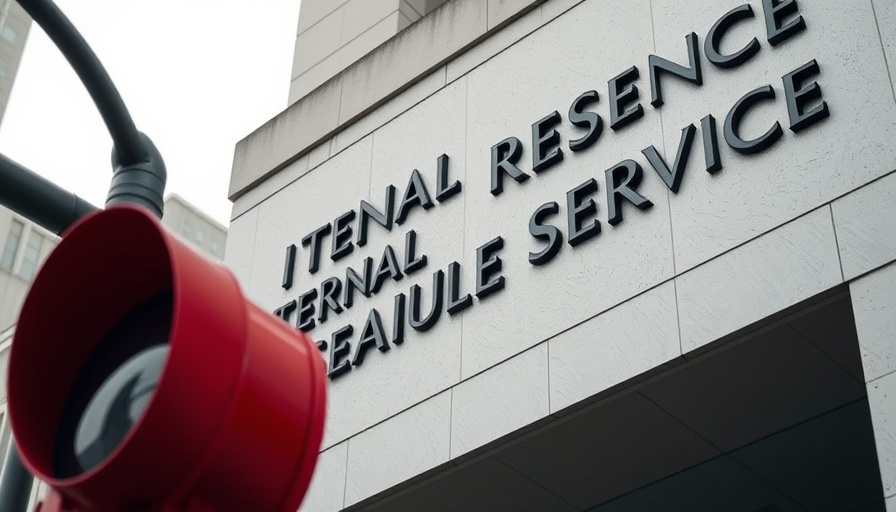

Critical Times Ahead: The IRS Projects $500 Billion Shortfall

In a remarkable forecast, the IRS has projected that the agency might collect up to $500 billion less in tax revenue than previously expected. This alarming statistic emerges as the U.S. approaches a critical juncture regarding its debt ceiling. Without an increase, the nation risks running out of cash in just a few months, igniting fears of a potential government default.

Implications for Businesses and the Economy

The potential for decreased tax collection could have far-reaching consequences for various industries. For businesses, especially small startups and local entrepreneurs in the Bay Area, this means less investment and limited access to capital. The tech industry, a pivotal player in the region's economy, could find growth stunted as consumer spending may decrease due to economic uncertainty. Business leaders might need to rethink their growth strategies and pivot towards sustainability and resilience during these challenging periods.

Understanding the Debt Ceiling Dilemma

The debt ceiling represents the maximum amount of money that the government can borrow to finance its existing legal obligations. When the ceiling is reached, Congress must authorize an increase or the government could default on its liabilities. This situation could adversely affect corporate earnings and may cause hesitance among venture capitalists looking to fund new business projects. The future of startup funding could depend heavily on the government’s fiscal health.

A Call for Resilient Business Strategies

In light of these challenges, businesses, especially startups in the Bay Area, should develop robust contingency plans and consider diversifying their funding sources. Moving forward, it will be crucial for organizations to adapt their business models to include sustainable practices and explore innovative funding solutions, including digital transformation initiatives. By doing this, they can better navigate the uncertain waters of the economy.

Add Row

Add Row  Add

Add

Write A Comment