Declining UK Disposable Income: A Wake-Up Call for Citizens

The latest reports indicate that UK disposable income has seen its sharpest decline since 2023, raising concerns for households across the country. As we delve into the implications of this trend, it's essential to understand the factors at play and what it could mean for the average consumer.

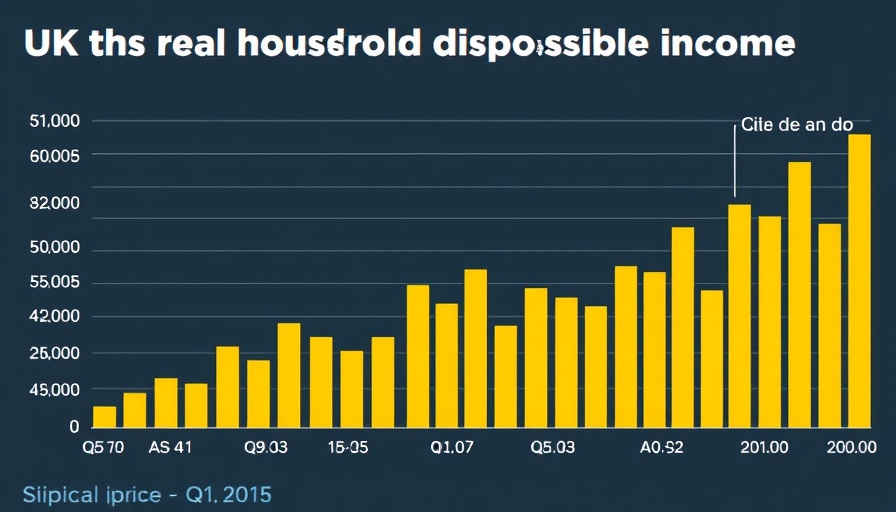

The Numbers Behind the Decline

According to recent economic data, UK disposable income has contracted significantly. This change reflects a combination of rising inflation, stagnant wage growth, and increasing living costs. Individuals and families are now feeling the pinch, prompting many to reassess their spending habits, savings, and investments.

Understanding Inflation and the Cost of Living

The inflation rate has been a driving force behind the shrinking disposable income. In basic terms, inflation indicates how rapidly prices for goods and services are rising. In the UK, households are encountering higher prices for essential items like food, fuel, and housing. As prices climb, the purchasing power of disposable income diminishes.

Comparative Analysis: Global Trends in Disposable Income

This decline in disposable income isn't just a UK-centric problem. Countries worldwide are grappling with similar economic pressures. For instance, in the United States, households are also reporting reduced disposable income due to elevated inflation rates influenced by supply chain disruptions and soaring energy costs. Examining these global patterns can provide insight into how interconnected and fragile our financial systems are.

The Local Economic Impact: Spotlight on the Bay Area

In the context of the Bay Area, where tech industry updates and Silicon Valley startups significantly impact market trends, the decline in disposable income raises alarms for consumer spending. This region, known for its dynamic economy, might face a slowdown in discretionary spending behaviors as families prioritize essential expenditures.

Tech Startups and Employment Trends: A Silver Lining?

While the economic downturn paints a concerning picture, it's important to recognize the opportunities it presents. Tech startups in the Bay Area are innovating continuously, driven by venture capital funding and a supportive ecosystem. As businesses adapt to changing consumer behavior and economic forecasts, employment trends may shift to evolve with a more resilient workforce.

Outlook: Future Predictions and Strategic Responses

Looking ahead, economists predict that inflation may continue to put pressure on disposable income. However, businesses can develop growth strategies to navigate these challenges. Embracing digital transformation, corporate social responsibility, and sustainability in business practices could foster long-term resilience against economic headwinds.

The Human Element: Emotional and Social Implications

The rise in living costs and the decline in disposable income can create emotional turmoil for individuals and families. Many may experience anxiety and uncertainty about their financial future, impacting mental health and community dynamics. Understanding these human aspects is crucial for businesses and policymakers who aim to support consumers effectively.

What Can Be Done? Practical Insights and Advice

In light of these circumstances, consumers must adopt practical strategies. Creating a budget, cutting non-essential expenses, and seeking investment opportunities that address local business needs can empower individuals during these challenging times. This proactive approach can help bolster financial stability amidst uncertain economic forecasts.

As the UK continues to face economic challenges, it's more important than ever to stay informed. Whether through understanding market analysis or staying updated on corporate earnings reports and business innovation, both consumers and businesses have a role in shaping a more resilient financial future.

Add Row

Add Row  Add

Add

Write A Comment