Trump's Economic 'Medicine': A Prescription for Market Turmoil?

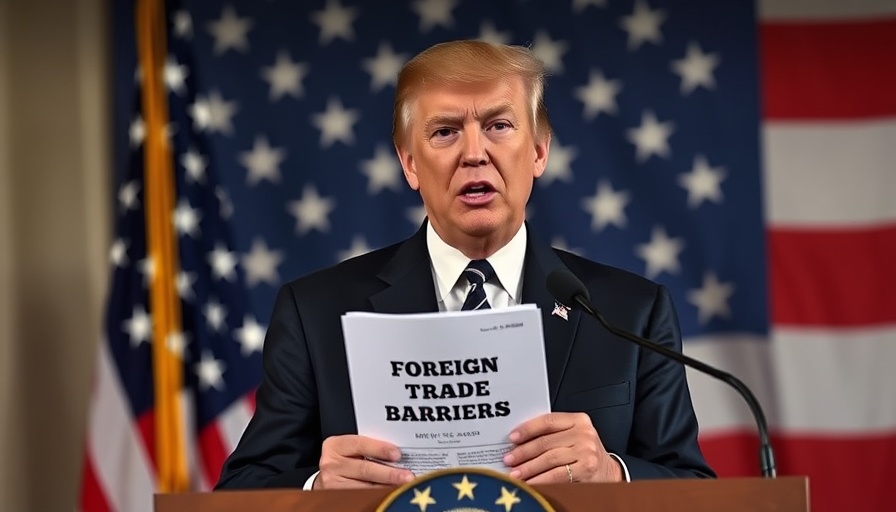

On a recent flight aboard Air Force One, former U.S. President Donald Trump addressed the growing concerns surrounding falling markets. When asked about this volatility, he remarked, "sometimes you have to take medicine to fix something". This statement encapsulates the complex relationship between government policy and market performance, particularly in light of Trump's controversial tariff strategies.

The Underlying Economic Context

Trump's assertion that his administration had been "treated badly by other countries" signifies his continued belief in the effectiveness of his tariffs. He refers to these protective measures as essential for rectifying trade imbalances. As Wall Street faced a significant downturn, with futures taking a hit, the implications of his policies became more pronounced. Observers note that the risk of a U.S. recession is rising, prompting speculation that the Federal Reserve may need to implement rate cuts as early as May to stabilize the economy.

Understanding Market Reactions

The stock market's recent performance reflects uncertainty over the economic repercussions of ongoing trade tensions, especially with China. Many investors are weighing the potential impact of the tariffs on various sectors, particularly those reliant on international supply chains. Stocks related to technology and manufacturing have seen notable fluctuations, leading many analysts to reassess their investment strategies.

Trump's Stance on China and Market Predictions

While Trump emphasizes the importance of resolving the trade deficit with China, his comments create a sense of unpredictability in the market. "What’s going to happen to the markets I can’t tell you… our country is much stronger," he stated. This ambiguity leaves investors pondering the future and looking for clues on how to navigate their portfolios effectively.

The Role of Investment Strategies in Uncertain Times

In light of market volatility, adopting well-rounded investment strategies becomes crucial. Diversification remains a key tenet in managing risk, underscoring the importance of exploring options like mutual funds, ETFs, and index funds that allow for broader market exposure. Moreover, during turbulent periods, defensive stocks, such as utilities and consumer staples, often provide stability and can act as a buffer against losses.

Future Predictions: Do We Expect Recovery?

Analysts remain divided on the trajectory of the economy under current policies. Some predict that if tariffs persist and trade tensions escalate, the markets will continue to experience significant instability. Others argue that a resolution could lead to rapid recovery, especially for sectors poised for growth in a stabilizing economic environment.

Investing for the Future: Tactical Approaches

Given the current landscape, it is essential for investors to focus on comprehensive and varied approaches. This could involve utilizing dollar-cost averaging to mitigate the risk of market timing or exploring alternative investments such as real estate crowdfunding or peer-to-peer lending. Furthermore, understanding one's risk tolerance is key to crafting a successful strategy during economically uncertain times.

Understanding Economic Indicators

Investors should remain vigilant regarding economic indicators such as inflation rates, employment data, and consumer confidence surveys. These metrics can provide insights into market tendencies and potential direction, making them critical for informed decision-making. With the additional backdrop of rising interest rates and their implications on various sectors, proper analysis can equip investors to formulate stronger portfolios.

The current market situation emphasizes a unique convergence of policy and investment strategy. Understanding these dynamics offers investors an opportunity to navigate through challenges while positioning themselves for future gains. As we move forward, keeping a close eye on market trends, engaging in continuous learning about investment options, and being prepared to adapt strategies will be crucial for financial success.

For those looking to deepen their understanding of the stock market and enhance their investment strategies, now is a pivotal time to engage with reliable financial education resources. Equip yourself with the knowledge to navigate both current volatility and future opportunities for growth.

Add Row

Add Row  Add

Add

Write A Comment