The Turning Tide: Ramelius Resources’ Q3 FY25 Performance

In an impressive display of resilience and strategic management, Ramelius Resources has showcased record cash flow figures in its recent Q3 FY25 presentation. The company's financial performance highlights not only its operational efficiencies but also a robust response to market dynamics. As the landscape for mining and resources evolves, Ramelius stands at the forefront, emphasizing sustainable and responsible practices while delivering shareholder value.

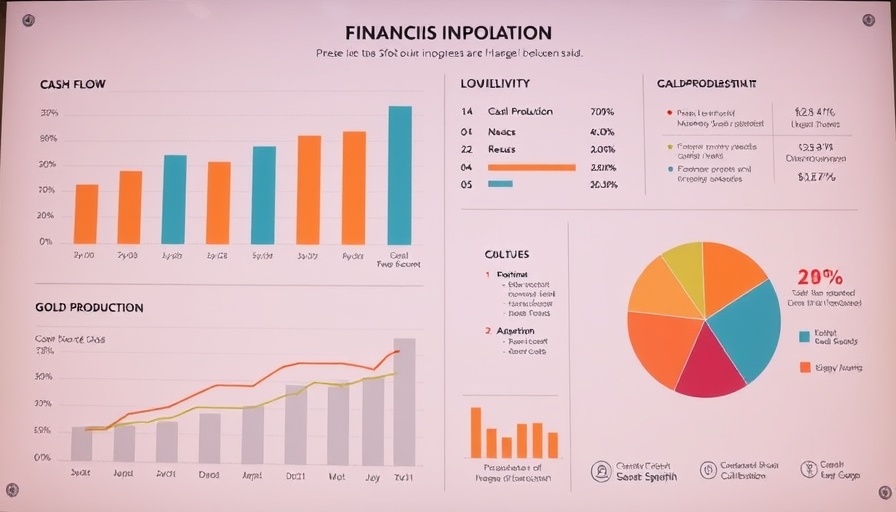

Understanding the Numbers: Record Cash Flow

During the third quarter of FY25, Ramelius Resources reported an astounding cash flow of $40 million, up significantly from the previous quarter. This achievement is a testament to the company’s operational excellence and adept management strategies in mining efficiencies, cost control, and market positioning. With this level of cash flow, Ramelius plans to bolster its investments in sustainable mining technology, ensuring both profitability and responsibility in its operations.

Upgraded Guidance: Optimism in a Volatile Market

The company announced updates to its guidance, projecting a stronger outlook for the remainder of FY25. This adjustment comes as a response to improved production rates and lower operational costs. The upgrade signals confidence from management regarding their strategic plans and the potential for continued growth in a highly competitive sector. National and global market factors impacting commodity prices indicate that Ramelius is aiming not only for short-term gains but also for long-term stability.

Market Impact: Implications for Investors

As Ramelius Resources demonstrates a strong operational performance, investors are keenly observing the stock market's reaction. Cash flow trends and upgraded guidance are markers of long-term value, which traditional and new investors alike should consider. For those new to investing, understanding cash flow's influence on stock valuations is crucial, particularly in sectors that experience fluctuations, like mining.

Strategizing for the Future: Investment Opportunities

Investor sentiment toward resource companies is often dictated by economic indicators such as inflation and commodity demand. The signs show promising trends for those looking to diversify portfolios through mining stocks. Traditional investment strategies like asset allocation can help investors manage risk effectively in a sector notorious for volatility.

For beginners in investing, engaging with ETF investing or mutual funds that focus on natural resources can provide a balanced approach to accessing markets like those Ramelius operates within. It’s vital to remember, whether exploring dividend stocks or ETFs, that diversifying investments may lead to greater resilience against market corrections.

The Bigger Picture: Ethical Investing Considerations

Moreover, ethical considerations are becoming paramount in investment strategies today. Companies like Ramelius are adopting more sustainable practices, which attracts a growing segment of investors keen on environmental, social, and governance (ESG) criteria.

For investors interested in long-term impact, exploring sustainable investing funds may yield both financial returns and positive contributions to societal changes. The growing trend towards sustainable and ethical investing reflects broader shifts among investors who wish to align portfolio choices with personal values.

Conclusion: Making Informed Investment Decisions

The recent presentation by Ramelius Resources serves as a case study on the importance of sound management, market awareness, and strategic planning in driving a company’s success. As investors assess their opportunities, understanding fiscal health indicators like cash flow, aligning investments with ethics, and employing effective strategies will be essential for navigating the ever-evolving landscape.

Whether you are looking at stocks, ETFs, or real estate, keeping a diversified portfolio that accommodates various market conditions can set the foundation for sustained success in the investment world. Engage and re-evaluate your strategy continually—as the market rewards those who remain informed and adaptable.

Add Row

Add Row  Add

Add

Write A Comment