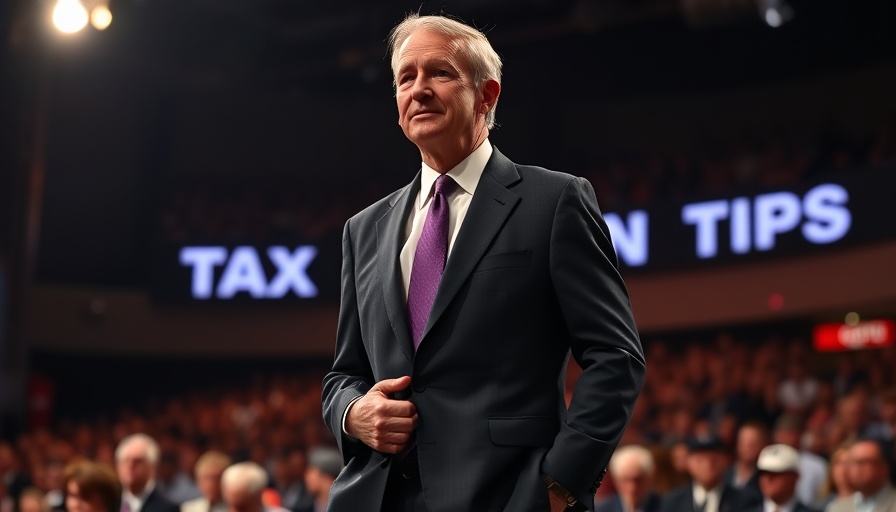

Trump’s Tax Proposal: An Overview

President Donald Trump’s latest tax reform proposal aims to eliminate taxes on tips and overtime pay, initiatives that reflect a potentially transformative vision for American workers and business owners alike. By proposing these changes, Trump is signaling a departure from conventional taxation structures, prioritizing job growth and income retention for the workforce at a crucial time.

The Benefits of Tax Reform

Removing taxes on tips allows service industry workers, who heavily depend on gratuities, to retain more of their income. This could lead to significant changes not only in their personal finances but also in overall consumer spending. Additional reform surrounding overtime pay reduction would incentivize employers to offer more hours and flexibility, which could potentially enhance productivity across various sectors.

Current Economic Trends and Their Impact

In the context of today’s economy, characterized by rising inflation and changing labor dynamics, tax reform initiatives can serve as crucial tools for stimulating local economies. According to recent reports, businesses are seeking innovative ways to adapt and grow amidst fluctuation, and these tax proposals could align well with overall business growth strategies. For example, discussions surrounding venture capital and funding news in Silicon Valley highlight how startups are increasingly reliant on sustainable business practices that match broader fiscal changes.

The Bigger Picture: Need for Broader Reform

While the proposed changes show promise, many argue that Trump’s reforms should extend beyond tips and overtime pay. Advocates for further reform suggest that these initial steps could act as catalysts for deeper, more comprehensive tax changes. As businesses navigate profitability in a post-pandemic world, comprehensive tax strategies could lead to enhanced corporate culture and innovation trends that support economic sustainability.

Industry Perspectives

Business professionals must weigh in on these proposed changes, as the implications could alter the landscape of both local and national economies. For example, insights drawn from Bay Area entrepreneurs and their experiences highlight the need for continued dialogue around business regulations updates that can impact job creation and economic resilience.

Conclusion and Call to Action

As business professionals reflect on the implications of Trump’s tax reforms, it becomes clear that understanding these changes is vital for informed strategic decision-making. Engaging with local business updates and participating in discussions regarding tax policies are essential for adapting and thriving in the evolving marketplace. Dive deeper into these concepts and connect with your community to stay ahead in today’s business environment.

Add Row

Add Row  Add

Add

Write A Comment