Japan's Push for Tariff Elimination: A Game Changer for Trade

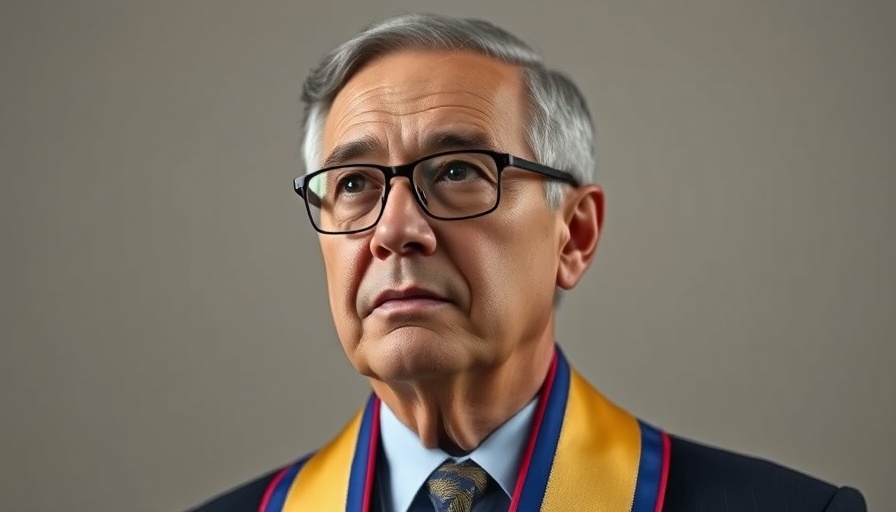

Japan's Prime Minister, Shigeru Ishiba, has taken a bold stance in advocating for the elimination of all tariffs between Japan and the United States. This statement, made during a recent press conference, has sparked discussions on the potential impact of such a move on both countries' economies and trade relationships.

The call to remove tariffs is not merely a political gesture but a strategic initiative aimed at enhancing economic cooperation. By eliminating these trade barriers, both nations could streamline the movement of goods, reducing prices for consumers while fostering more competitive environments for businesses. Such actions could pave the way for enhanced collaboration in various sectors including technology, agriculture, and manufacturing.

Understanding Tariffs and Their Economic Impact

Tariffs are taxes imposed on imported goods, which can lead to an increase in prices for consumers. They are often used to protect domestic industries from foreign competition. However, the rising trend of globalization suggests that eliminating tariffs may benefit both producers and consumers in the long run. This perspective aligns with emerging market strategies where businesses leverage international partnerships to gain access to broader markets.

Ishiba's position resonates with many economists who argue that open trade can lead to more innovation and efficiency in industries. The question remains, however, regarding how swiftly these changes could occur and whether both countries are prepared for a shift in trade dynamics.

Potential Benefits of Eliminating Tariffs

The benefits of removing tariffs extend beyond just immediate cost savings for consumers. For investors, this could mean exploring new international investment strategies, especially in sectors like technology and alternative energies, which are crucial for the future of both Japan and the US.

For instance, ETF investing could become more lucrative if tariffs on tech products are lifted, allowing American and Japanese companies to expand their product offerings without the added costs. This reciprocity could be a catalyst for mutual growth, lending itself to increased investment opportunities across various platforms, including mutual funds and real estate investment trusts (REITs).

Concerns and Counterarguments

Despite the potential benefits, there are concerns about the implications of removing tariffs. Domestic industries could face challenges from increased foreign competition. Small businesses in Japan may struggle to compete against larger US corporations, potentially leading to job losses in some sectors.

Moreover, the economic landscape is deeply influenced by global markets. Emerging markets could cushion the impact of tariff removal, but will they be able to compete effectively? Understanding these dynamics is crucial for investors that focus on portfolio diversification and risk management in investing.

Future Predictions: A Shift in Trade Strategy

The future of US-Japan trade relations will significantly depend on how both governments navigate this proposal. Should tariffs be eliminated, it would signal a transformative shift in international trade strategies, positioning both nations to better invest in emerging technologies and sustainable business practices.

Investors should remain vigilant as market corrections and volatility can occur amid major policy shifts. Now may be an excellent time for those interested in innovative investments to recalibrate their strategies—perhaps by exploring sustainable investments that align with the global push for more eco-friendly practices.

Taking Action: What This Means For Investors

For investors, the developments in US-Japan relations must be monitored closely. Understanding the implications of tariff removal can aid in making informed decisions. Strategies like dollar-cost averaging and diversification can help manage risk while optimizing portfolio performance.

With insights into trade dynamics and investment avenues, this is an ideal juncture to evaluate asset allocation strategies, and consider sectors likely to benefit from increased trade, such as healthcare stocks and renewable energy companies.

Conclusion: A Call to Stay Informed

The potential elimination of tariffs between Japan and the US presents a unique landscape for both consumers and investors. While there are positive aspects to consider, the complexities of domestic industries and the global market must not be overlooked. As discussions progress, maintaining an informed stance on investment strategies will be crucial for navigating the ever-evolving economic landscape.

Add Row

Add Row  Add

Add

Write A Comment