StrongPoint's Q2 Growth: A Closer Look

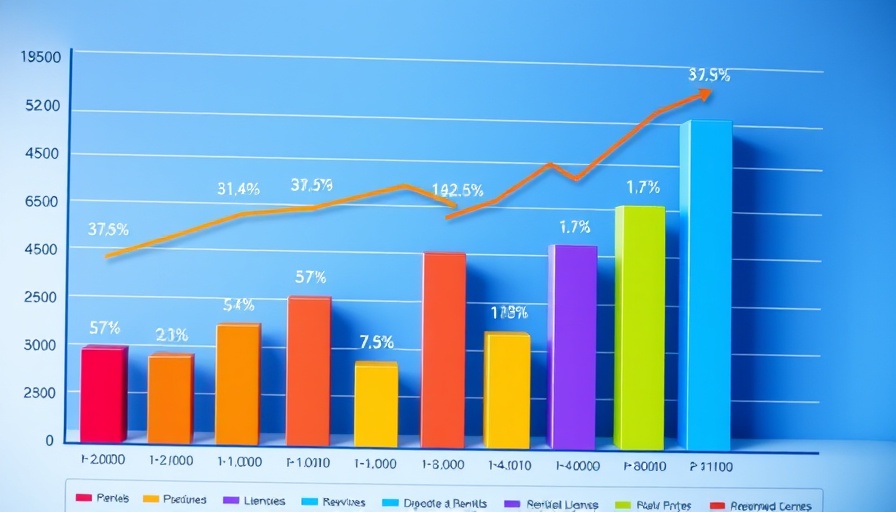

StrongPoint ASA has released its Q2 2025 financials, spotlighting an impressive 18% increase in revenue compared to the previous year. The Nordic retail technology provider continues to cement its position in the European grocery sector, showing resilience despite the economic uncertainties that have plagued many industries.

Understanding the Retail Technology Boom

The retail technology landscape is expanding rapidly. As grocery retailers push for operational efficiency amidst increasing competition, companies like StrongPoint offer critical solutions ranging from e-commerce fulfillment to advanced cash handling systems. The latest figures not only highlight StrongPoint’s robust performance but also underscore a broader trend within retail technology, where businesses are prioritizing digital transformation.

The Importance of EBITDA in Evaluating Financial Health

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a valuable metric many investors look at for assessing company performance. StrongPoint's improvement in EBITDA reflects not just revenue growth but better management of operational costs. This strategic focus has positioned the company well against competitors in the retail tech sector.

Impact of StrongPoint's Growth on Investment Opportunities

In light of StrongPoint's financial successes, investors might explore potential opportunities within the retail technology space. Investment strategies focusing on growth stocks in tech often yield benefits, especially in sectors that are innovating rapidly. For instance, the surge in online grocery shopping during recent years has led to increased interest in companies that provide the infrastructure for this transition.

Predicting Future Trends in Retail Technology

The growth trajectory of companies like StrongPoint signals a promising future. As retailers invest more in technology, new market segments may emerge, paving the way for start-ups and established players alike. Analysts anticipate that automation and AI will transform retail operations further, providing additional investment avenues.

Sector-Based Investing: Key Takeaways

For investors eyeing the retail sector, understanding the nuances of sector-based investing could lead to better portfolio outcomes. Choosing stocks based on industry trends—such as StrongPoint’s innovative technology—can enhance portfolio diversification and mitigate risks, especially in volatile markets.

Conclusion: Why Now is the Time for Investors to Pay Attention

As StrongPoint demonstrates, leveraging technology within the retail sector is not only boosting company performance but also attracts investor interest. Amidst a backdrop of economic challenges, those willing to explore investments in retail technologies could find themselves ahead of the curve. Understanding the implications of strong earnings reports like StrongPoint's can guide informed investment decisions, especially in growth and tech stocks.

Add Row

Add Row  Add

Add

Write A Comment