The Rise of Deposit Growth in Indonesia's Banking Sector

Bank Rakyat Indonesia (BRI), a key player in the Indonesian banking landscape, revealed significant insights in its first half 2025 financial update. One of the most notable highlights is the bank’s impressive deposit growth, which has outpaced loan growth amid a nationwide push towards digital banking. This shift is not just a strategic move for BRI, but a reflection of evolving consumer behaviors in Indonesia, where digital solutions have become increasingly vital.

Navigating Economic Challenges

Despite Indonesia's GDP growth remaining stable at approximately 4.78% in the second quarter of 2025, the middle and lower economic strata are still grappling with challenges. Purchasing power for many Indonesians has yet to reach the levels seen before the pandemic, making financial resilience essential. BRI’s focus on enhancing its deposit franchise aligns with this need, as consumers are more likely to prioritize savings in uncertain times.

The Digital Push: Transforming the Banking Landscape

The ongoing digital revolution plays a pivotal role in how banks operate. For BRI, bolstering digital initiatives means not just improving customer experience but also optimizing operational efficiency. By investing in digital banking platforms, BRI aims to create a seamless interface that caters to the growing demand for online banking, particularly among younger, tech-savvy customers. This strategy reflects a broader trend in Indonesia's banking sector, where digital transformation is no longer optional but a necessity.

Long-term Share Performance: A Reliable Investment?

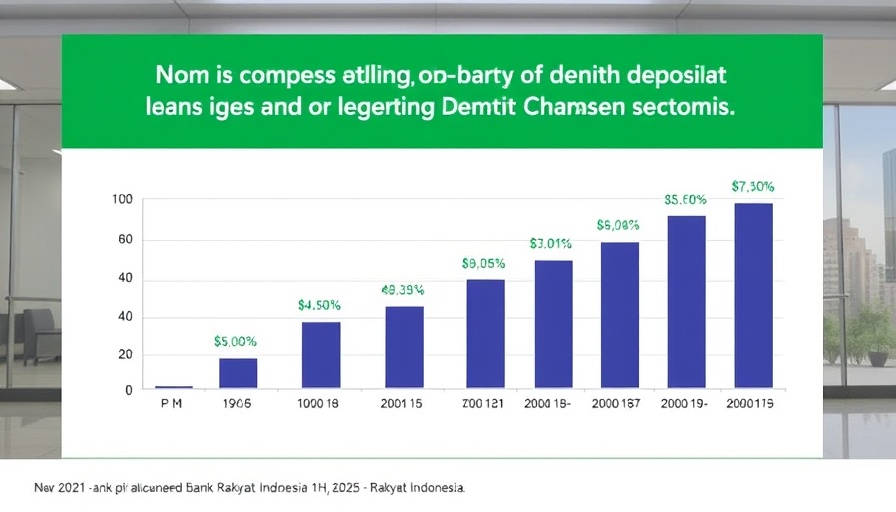

Looking at the long-term performance of BRI’s shares, investors have witnessed an astonishing increase of 4,400% since the bank's IPO. Compared to the Jakarta Composite Index's growth of 1,117% during the same period, BRI has showcased its resilience and strategic prowess in navigating market fluctuations. With 69.89% domestic investor holdings, BRI solidifies its acceptance and trust within the local market, indicating a promising outlook for investments in the banking sector.

Investment Strategies in the Current Climate

Amidst changing economic indicators and the rise of digital banking, investors must reevaluate their strategies. As inflation remains a concern, inflation protection investments become crucial. Exploring avenues like real estate investing, high-yield bonds, and dividend stocks can enhance portfolio performance while managing risk. For those interested in more aggressive tactics, growth stocks in the tech sector stand out as attractive options, especially as banks like BRI adapt to technological changes.

Practical Insights for Savvy Investors

With BRI’s recent updates in mind, investors should consider the following actionable insights:

- Monitor Economic Indicators: Stay informed about Indonesia's economic health, especially GDP growth and inflation rates, to make educated investment decisions.

- Diversify Your Portfolio: Use BRI’s strategy as a model for risk management. Diversification helps to mitigate risks associated with any single financial sector.

- Leverage Digital Investment Tools: Platforms like robo-advisors and investment apps can support informed decision-making processes, particularly for those new to investing.

Conclusion: Charting a Secure Investment Path

The financial narrative painted by Bank Rakyat Indonesia reinforces the importance of adaptability in today’s banking sector. As digital banking becomes increasingly essential, investors must stay ahead of trends while ensuring their portfolios reflect a balanced risk approach. As we navigate a complex economic landscape, the insights garnered from BRI's practices can serve as a roadmap for success.

Add Row

Add Row  Add

Add

Write A Comment