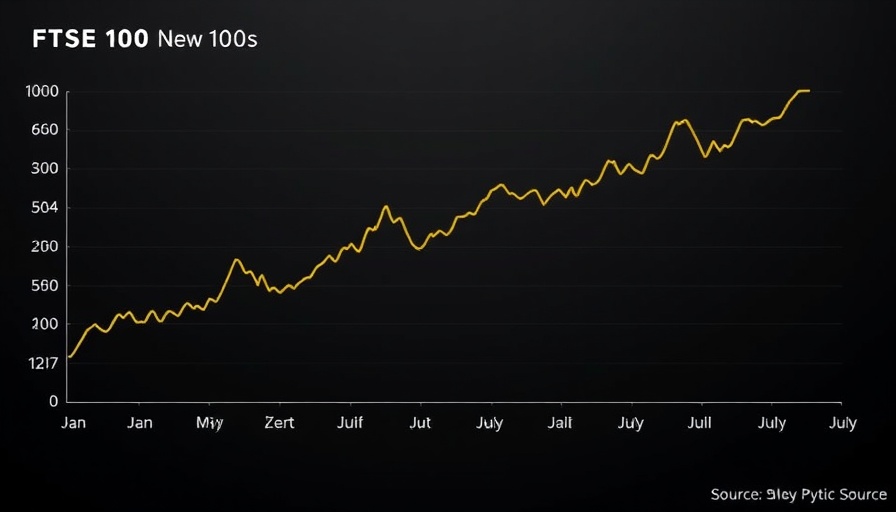

FTSE 100 Achieves Historic Milestone at 9,000 Points

In a landmark achievement, the FTSE 100 index has reached 9,000 points for the first time, marking a significant milestone in the history of the UK’s financial market. This critical point not only indicates growth across various sectors but serves as a reflection of the resilience and performance of the UK economy amidst global economic challenges.

The Implications of the 9,000 Points Milestone

The FTSE 100 reaching this threshold signifies several potential impacts on both local and global markets. Investors generally perceive this as a sign of optimism; strong corporate earnings and positive economic forecasts fuel this surge. Companies like AstraZeneca and HSBC have shown impressive earnings, contributing to this upward trajectory. Moreover, this point is a confidence booster, attracting new investments and potentially sparking a renewed interest in the UK market.

Exploring Economic Trends Behind the Increase

Several factors have contributed to this increase, one being the steady recovery from the pandemic’s economic fallout. The resurgence in consumer spending, especially in the retail and tech sectors, has shown promising trends. Venture capital funding, particularly in technology, has surged, driving innovations and new business creations, especially in the Silicon Valley startup space, influencing similar interests in the UK.

What This Means for Investors

For investors, the crossing of 9,000 points may lead to a shift in strategy. Historical data suggests that such milestones often push investors to reevaluate their portfolios and seek out emerging opportunities in sectors that may be disrupted or poised for growth. Business growth strategies focusing on sustainability and corporate social responsibility may also gain traction, emphasizing the need for businesses to align with modern consumer expectations.

Consumer Behavior Trends Influenced by Economic Growth

The upward movement of the FTSE 100 may alter consumer behavior as well. Increased wealth often correlates with greater spending power. With reports on corporate earnings rising, businesses might tap into this potential boost in consumer and investor confidence by aligning their offerings with current trends in e-commerce and digital transformation.

Future Predictions: Will Growth Continue?

Looking ahead, many analysts believe that while the FTSE 100’s rise reflects positive economic sentiment, challenges remain in the form of inflationary pressures and global market volatility. Economic forecasts suggest that while the growth momentum may continue, it will require strategic navigation considering potential supply chain disruptions and the evolving employment landscape.

Key Takeaways for the Tech Industry

With the UK’s economic landscape appearing robust, it’s vital for Bay Area tech startups to observe these market dynamics. Emerging technologies and innovation in business practices spotlight opportunities for sustainable growth. Insights from the FTSE milestone can provide relevant lessons for regional entrepreneurs as they seek venture capital funding and explore mergers and acquisitions within a competitive climate.

This pivotal moment in economic history serves as a reminder of the interconnectedness of global markets. Understanding these trends is essential for businesses aiming to remain agile and responsive to evolving consumer behavior and economic realities.

Add Row

Add Row  Add

Add

Write A Comment