In the rapidly evolving bicycle market, few companies exemplify sustainable mid-sized bike brand growth as remarkably as Neuhaus Metalworks. Their unique blend of craftsmanship, strategic pricing, and customer-centric innovation has allowed them to carve out a respected position beyond their Californian origins. Dive into the story of how a passion-driven, small-batch bike brand harnesses quality, community, and smart market positioning to thrive amidst industry giants.

Startling Facts About the Mid-Sized Bike Brand Growth in the Bicycle Market

The bicycle industry is experiencing an impressive surge with growing consumer interest in both urban mobility and outdoor recreation. The mid-sized bike brand growth sector is particularly notable for balancing personalized service alongside scalable production. What may come as a surprise is that Neuhaus Metalworks, rooted in the heart of Marin County—widely regarded as the birthplace of mountain biking—sells a majority of their bikes outside their home state of California. This geographic reach underscores the brand’s ability to tap into a broader market beyond just its local community.

Current Trends in the Bike Industry and Market Size

Nick Neuhaus, of Neuhaus Metalworks, explains, "Our success really kind of thrives off of our lack of overhead and a focus on quality over quantity."

Contemporary trends in the bike market indicate a substantial shift towards smaller, more agile manufacturers who can offer quality and customization without the overhead of large production entities. The industry size continues expanding, especially post-pandemic, as outdoor activities gain renewed popularity. Mid-sized brands like Neuhaus are leveraging these trends by balancing custom craftsmanship with selective small-batch production, reaching consumers demanding both quality and affordability.

The Origins and Vision Behind Neuhaus Metalworks’ Mid-Sized Bike Brand Growth

From Fabrication Roots to Custom Bike Building

Nick Neuhaus’ journey began not in the bicycle industry but nurtured by a life surrounded by skilled trades—the family garage was the proving ground for auto repair and fabrication. This hands-on upbringing laid the foundation for his eventual shift into custom bike building. Initially a hobby, his fabrication skills and passion for cycling drove the creation of unique bikes tailored to individual needs. This origin ingrained a value system focused on quality and precision that continues to define Neuhaus Metalworks' approach.

Transitioning from Custom to Small-Batch Production

Nick Neuhaus shares, "The business itself started as just a hobby... and grew quickly with the help of high-profile influencers and market demand."

As demand grew, partly fueled by notable cycling influencers during the outdoor recreation boom, Neuhaus faced the challenge of scaling without sacrificing authenticity. The solution was a collaboration with an engineer to standardize the best aspects of their custom work into a limited production line. This strategic move allowed the brand to supply a broader audience while retaining its hallmark of thoughtfully designed, size-specific geometry frames.

Pricing Strategies and Market Positioning in the Mid-Sized Bike Brand Growth

Comparing Custom and Production Bike Price Ranges

The pricing spectrum at Neuhaus Metalworks reflects a careful balance between exclusivity and accessibility. Custom steel frames begin around $2,500 , complete builds climbing up to $5,000+, while titanium custom frames start at $5,000 with builds going higher. Conversely, their production bikes retail for approximately $1,199 for the frame only, making quality craftsmanship more accessible to a wider market segment. This tiered pricing structure sustains the brand’s appeal to both enthusiasts seeking bespoke options and riders desiring trusted, affordable builds.

Balancing Affordability with Quality in the Bike Market

According to Nick Neuhaus, "Our production bikes retail for $1,199 for the frame, making quality accessible without compromising our standards."

By maintaining a direct-to-consumer model and partnering overseas for production runs in Taiwan, Neuhaus Metalworks smartly manages costs while upholding rigorous quality standards. This approach enables the brand to compete against much larger players, ensuring that quality and performance remain paramount. Strategically setting price points that respect customers’ budgets reinforces their competitive position in a saturated market.

Customer Service and Warranty: Building Trust in a Mid-Sized Bike Brand

Direct-to-Consumer Model and Assembly Recommendations

The Neuhaus Metalworks' direct-to-consumer sales framework fosters a transparent and personal relationship with buyers. Customers receive unassembled bikes shipped to their homes with strong recommendations to utilize local bike shops for professional assembly. This not only ensures safety and optimal setup but also nurtures community collaboration, bolstering brand loyalty.

Five-Year Warranty and Handling Manufacturing Defects

Nick Neuhaus emphasizes, "We have a five-year warranty against manufacturer defects and take care of customers even in unfortunate accidents."

The brand’s confidence in materials and craftsmanship is reflected in its generous five-year warranty covering manufacturer defects. Nick Neuhaus acknowledges that while no manufacturing process is perfect, the company's commitment extends to addressing issues promptly, even for damages caused by accidents. This level of dedicated aftercare reinforces trust and demonstrates the brand’s long-term commitment to customer satisfaction.

Innovations and Differentiators in Neuhaus Metalworks’ Mid-Sized Bike Brand Growth

Size-Specific Tubing and Geometry for Diverse Rider Needs

Neuhaus Metalworks distinguishes itself by designing frames with tubing and geometry tailored precisely to rider size. Recognizing the difficulty very tall or short riders face in finding suitable bikes, the brand innovates sizing options that enhance comfort and performance. This thoughtful differentiation is a key driver in attracting and retaining niche customer segments often overlooked by mass manufacturers.

Customization Options: Colors and Attachment Points

Nick Neuhaus notes, "We cater especially to riders at the height extremes, ensuring a perfect fit and ride experience."

Beyond size, Neuhaus Metalworks offers flexible customization in colors and attachment points, reflecting the creative and practical desires of modern cyclists. Offering an open palette of colors allows riders to express their personalities, while customizable attachment points facilitate various bike uses, from commuting to rugged trail riding. This fusion of personalization with standard quality emphasizes the brand’s commitment to rider-centric design.

Market Segmentation and Geographic Reach in the Bicycle Market

Sales Distribution: Beyond the Bay Area and California

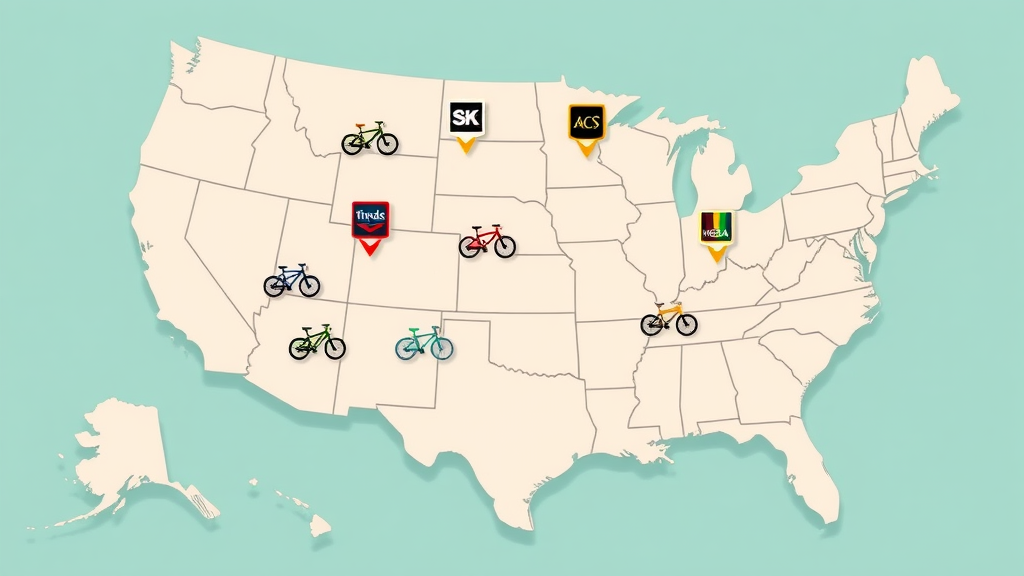

Although located in Novato, near the cycling-rich Bay Area, Neuhaus Metalworks generates a majority of its sales nationally and even internationally. This broad geographic reach demonstrates the universal appeal of their approach and the strength of digital marketing combined with community networks. Suburban and rural riders across the United States increasingly represent key customers, expanding the brand’s footprint significantly beyond its local base.

Expanding Production with Overseas Partnerships in Taiwan

To accommodate increasing demand while maintaining quality control, Neuhaus Metalworks forged strategic partnerships with Taiwanese factories. These collaborations leverage Taiwan’s reputation for high-quality cycling manufacturing and specialized tubing production, allowing Neuhaus to scale with confidence. This overseas production strategy enables the brand to keep batch sizes manageable and quality consistent, a critical factor in sustaining mid-sized bike brand growth.

Challenges and Opportunities in Growing a Mid-Sized Bike Brand

Managing Demand and Scaling Production

One central challenge Neuhaus faces is balancing demand with the artisanal nature of their product. Rather than mass-producing large quantities, they prioritize maintaining the small-batch quality that defines their brand identity. This careful scaling approach means managing production timelines and inventory prudently, ensuring that the brand does not overextend itself or compromise its core values.

Maintaining Brand Ethos Amid Market Growth

Nick Neuhaus reflects, "Our goal is to grow a company that lives beyond me, focusing on a core ethos rather than mass-market dominance."

Preserving the authentic spirit of Neuhaus Metalworks as the company grows is a deliberate priority. Nick Neuhaus envisions building a legacy company rooted in quality, community, and rider satisfaction rather than succumbing to mass-market pressures. This ethos-driven strategy sets the stage for sustainable, lasting growth within the competitive cycling industry.

What You'll Learn: Key Takeaways on Mid-Sized Bike Brand Growth

- The importance of balancing custom craftsmanship with scalable production to meet growing market demands.

- Pricing strategies that appeal to diverse customer segments without sacrificing quality.

- The role of direct-to-consumer sales and comprehensive warranty in fostering customer trust and satisfaction.

- Innovative design approaches providing size-specific geometry and extensive customization options for riders.

- Strategic geographic market expansion and overseas partnerships fueling sustainable mid-sized bike brand growth.

Comparison of Custom vs Production Bike Pricing and Features

| Feature | Custom Bikes | Production Bikes |

|---|---|---|

| Frame Material Options | Steel and Titanium | Steel |

| Starting Frame Price | $2,500 (Steel), $5,000 (Titanium) | $1,199 |

| Complete Bike Price Range | $5,000 - $8,000+ | Starting at $3,500 |

| Customization Options | Full geometry tailoring, color, attachment points | Fixed geometry with selectable colors and add-ons |

| Production Volume | Small batch, individual builds | Limited batch production (~100 units per batch) |

| Warranty | 5 years against manufacturing defects | 5 years against manufacturing defects |

People Also Ask: FAQs on the Bike Industry and Mid-Sized Bike Brand Growth

Is the bike industry growing?

Yes, the bike industry continues to grow steadily, driven by heightened interest in health, commuting alternatives, and outdoor activities. Mid-sized bike brands are especially benefitting from this growth as consumers seek quality and personalization over mass production.

What are the top bike brands in 2025?

Leading the market in 2025 are industry giants like Trek, Specialized, and Giant, yet mid-sized brands such as Neuhaus Metalworks are gaining traction for their customer-focused innovation and niche appeal.

What is the most sold bicycle brand?

Mass-market brands such as Giant and Trek dominate sales volume globally. However, mid-sized brands maintain strong regional and specialized market segments based on quality and customization.

Who are the big 3 bike manufacturers?

The "Big 3" bike manufacturers typically refer to Trek, Specialized, and Giant—companies with extensive global distribution, expansive product lines, and vast manufacturing capacities.

Conclusion: Sustaining Growth and Authenticity in a Mid-Sized Bike Brand

Nick Neuhaus concludes, "We just sort of keep things a little more thought out in terms of the name, and it reminds us why we do it — for ourselves first, because we love bikes."

Neuhaus Metalworks exemplifies how a mid-sized bike brand can grow sustainably by staying true to core values, innovating thoughtfully, and prioritizing quality over scale. Their approach, fueled by passion and strategic foresight, promises a lasting presence in the competitive bicycle industry. For aspiring brands, Neuhaus demonstrates that success doesn’t require mass-market domination but a commitment to excellence and rider experience.

Contact Neuhaus Metalworks

- For inquiries and custom orders, contact Nick Neuhaus at nick@neuhausmetalworks.com

The mid-sized bike market is experiencing significant growth, with companies like Royal Enfield leading the charge. In an article titled “Mid-size motorcycle market to grow in high-single digits in FY25, says Royal Enfield CEO,” Royal Enfield’s CEO, B Govindarajan, discusses the anticipated high-single-digit growth in the mid-size motorcycle segment for the current financial year. He highlights the increasing demand for motorcycles with engine capacities between 250-700 cc and the company’s plans to introduce new models to meet this demand. ( autocarpro.in )

Another insightful resource is the article “Two-wheeler makers plan new launches in mid-size bike segment to challenge Royal Enfield’s dominance,” which explores how various two-wheeler manufacturers are planning to launch new models in the mid-size bike segment to compete with Royal Enfield. The piece discusses the strategies of companies like Hero MotoCorp, Honda Motorcycle & Scooter India, and Bajaj Auto as they aim to capture a share of this growing market. ( economictimes.indiatimes.com )

If you’re interested in understanding the dynamics of mid-sized bike brand growth and the competitive landscape, these resources provide valuable insights into market trends and strategic initiatives.

Add Row

Add Row  Add

Add

Write A Comment