Understanding the Fallout of GM's Tariff Costs

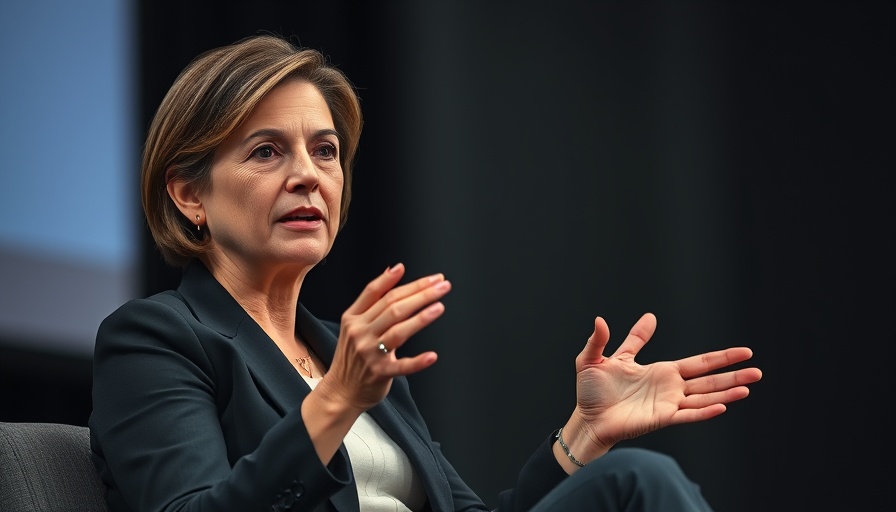

General Motors has reported a staggering $1.1 billion hit to profits, a clear signal of the profound impact tariffs are having on American businesses and consumers. The recent announcement comes as GM trails behind its rivals in sales, with a 2% drop leading to $47 billion in revenue during the last quarter. Despite posting better than expected profits, the decrease reflects rising costs and strategic adjustments led by CEO Mary Barra, who acknowledges the negative effects of the Trump administration's trade policies.

The Broader Economic Context: Who Really Pays?

Economists and analysts are increasingly pointing to a troubling reality: the costs of tariffs are being shouldered disproportionately by Americans. For instance, a Deutsche Bank report indicated that, although the U.S. Treasury is set to collect around $100 billion in customs duties in the current fiscal year, this revenue has not translated into lower prices for imported goods. While American importers are paying these tariffs, prices have largely remained unchanged, suggesting that these costs will ultimately be passed down to consumers.

Impact Across the Industry

GM is not alone in feeling the bite of these tariffs. Stellantis, the company behind Jeep and Ram Trucks, recently reported a loss of $2.7 billion for the first half of the year, attributing significant portions of this loss to the effects of U.S. tariffs. This scenario paints a worrying picture for the automotive industry as it grapples with production adjustments and increased manufacturing costs, raising questions about long-term sustainability and profitability.

Future Predictions: Economic Repercussions Ahead

The implications of these tariffs extend beyond the automotive sector. As industries reevaluate their supply chains and pricing strategies, we could see a ripple effect throughout the economy. Analysts predict that continued reliance on imported materials and components will tighten margins for businesses, potentially leading to increased prices for consumers and a slowdown in overall economic growth if current policies persist.

Conclusions and Next Steps

As companies like GM and Stellantis navigate these turbulent waters, stakeholders from consumers to policymakers need to be aware of the intertwined nature of trade policies and domestic economic health. Exploring avenues for domestic production and securing stable supply chains may be critical strategies moving forward. Businesses are encouraged to stay vigilant and adapt, considering the ever-evolving landscape shaped by tariffs and trade agreements.

In light of these discussions, it’s important for business professionals to engage with local policies, understand market dynamics, and adapt strategies that take into account the broader economic changes we are witnessing.

Add Row

Add Row  Add

Add

Write A Comment