The Perils of AI Optimism: A Modern Market Analysis

As we delve deeper into the era of artificial intelligence, markets are experiencing what Deutsche Bank analysts describe as "the summer AI turned ugly." With rising concerns about the sustainability of tech stocks, particularly those linked to AI, industry watchers are drawing parallels to the infamous dot-com bubble of the late 1990s. However, the current situation reveals a more complex narrative.

Understanding Today's Market Landscape

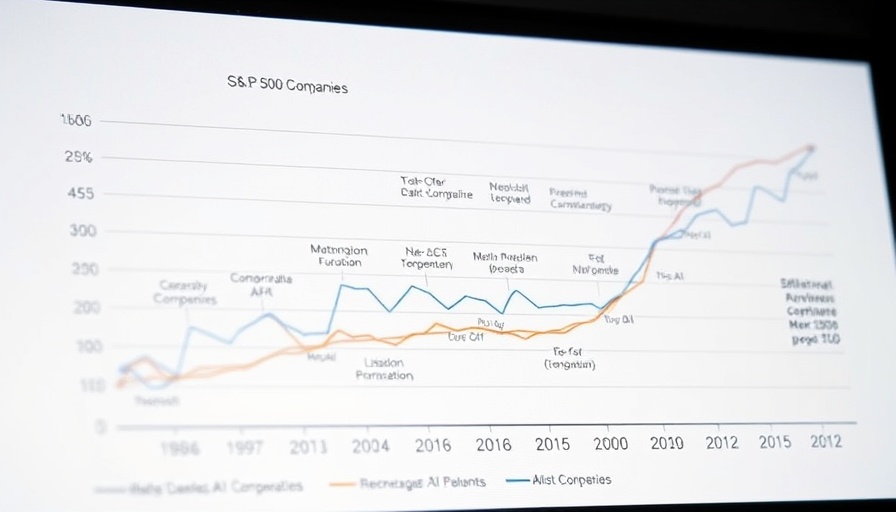

Despite the hype surrounding AI, Deutsche Bank's analysis indicates that today’s market is displaying a more sober approach compared to the exuberance seen during the dot-com bubble. While stock valuations indeed surged, especially with the dominance of tech giants like Nvidia and Amazon, the analysts argue that these companies possess healthier balance sheets than their predecessors, significantly cushioning them against potential downturns.

AI and the Capital Dilemma

A troubling aspect of the emerging AI market is the massive investments in data centers. Deutsche Bank highlights an alarming analysis from Praetorian Capital, suggesting that these investments might yield negative returns, reminiscent of past cycles characterized by 'capital destruction.' As businesses chase growth in AI, they must weigh the sustainability of these expenses against the backdrop of economic volatility.

Can AI Live Up to the Hype?

Web searches related to AI have far surpassed those of cryptocurrencies, indicating an unprecedented level of public interest. However, this fervor raises the crucial question: can AI technologies deliver the transformative impact investors are banking on? With high-profile investment and predictions, the stakes are higher than ever.

Future Predictions: The Road Ahead

Looking ahead, the AI landscape will likely continue to evolve rapidly. Companies must remain agile, adapting strategies that prioritize not just growth but also sustainable practices. The hope for a soft landing in the market is palpable but remains fraught with uncertainties rooted in overvaluation and market hype.

In conclusion, while the allure of AI is undeniable, investors and businesses alike must approach the sector with caution and critical analysis. As AI continues to permeate various industries, the lessons from past market cycles must guide future investments and innovations, steering away from blind optimism to a more grounded, strategic outlook. Understanding these dynamics will be crucial for anyone involved in the technology sector.

Add Row

Add Row  Add

Add

Write A Comment